adsense

prediction top golds prices on october 2011

5:11 AM

5:11 AM

Unknown

Unknown

prediction top golds prices on october 2011

mines,gold,silver,oil,gazz,coal,prices,market,asia, europa,america,africa

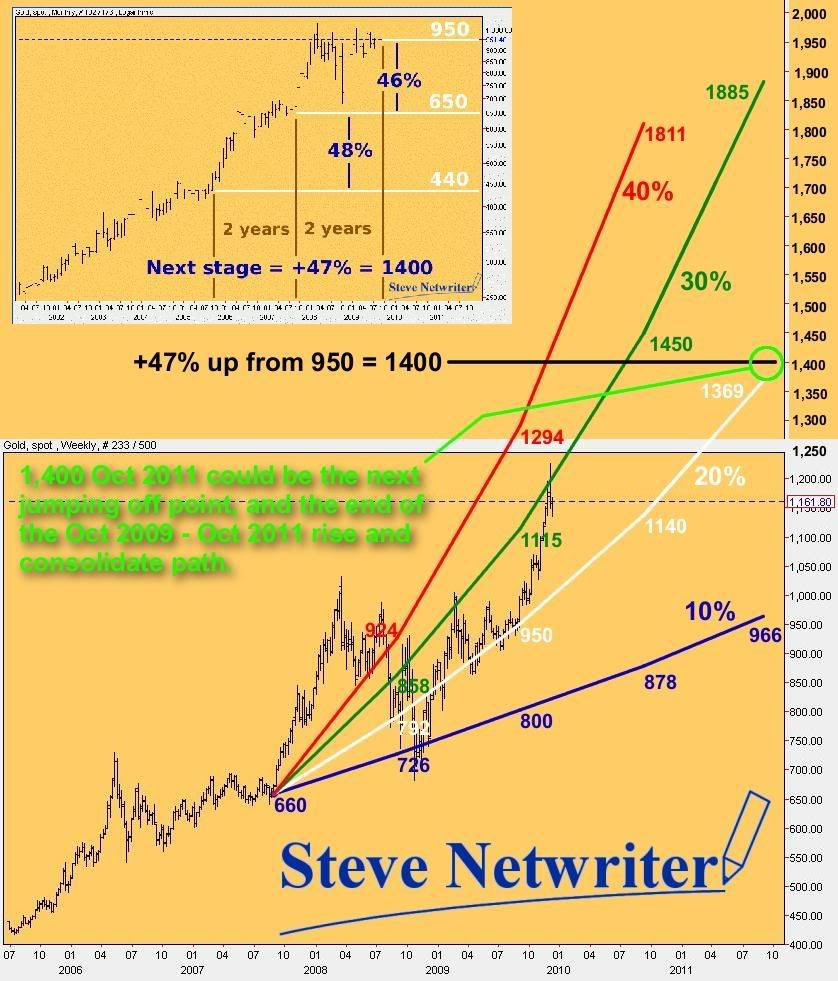

This allows the current 'price' to be compared with various growth rates.

I have also inset a previous chart of mine which shows how gold rises, then consolidates, and then rises again.

These periods have been 2 years in length, and have seen rises of about 47% each time.

This allows me to make a prediction. Gold will rise to somewhere over 1400, will then consolidate until Oct 2011, where it will be at about 1400. At that time it will then mount another rise.

A 20%/year growth rate would lead to a GoldUS$ rate of about 6,000 in 2020. That is towards the lower end of the various predictions using money supply etc.

I suggest that anywhere near or below the 20%/year line is a buying opportunity.

I will return to this in Oct 2011 and review my prediction.

I would not be surprised to see a much higher 'price' by then, but I think that 1400 is a good conservative target.

Such events cannot easily be predicted. So one must position oneself just in case.

I have just created the following chart. It shows the historical 'price' of gold in US$. What I prefer to call the GoldUS$ exchange rate.

I have plotted 4x growth rates on it, all based on the end of the consolidation period at 660.

Blue shows a 10%/year growth rate.

White shows a 20%/year growth rate.

Green shows a 30%/year growth rate.

Red shows a 40%/year growth rate.

Here are two very good options for buying gold & silver and having them stored for you in secure insured vaults:

sources: http://neuralnetwriter.cylo42.com/node/2463

Posted in

Posted in

No Response to "prediction top golds prices on october 2011"

Post a Comment